How to Legally Keep More of Your Money

The Wealth Drain That High-Income Earners Overlook

For high-income professionals, business owners, and investors, taxes are one of the biggest obstacles to building and preserving wealth. No matter how much you earn, it often feels like the government takes an ever-growing slice of your income, leaving you frustrated and searching for ways to legally minimize your tax burden.

- Are you tired of giving away 30-50% of your earnings in taxes?

- Have you maxed out your 401(k) and other tax-advantaged accounts but still want to shield more wealth?

- Do you want a tax-free lending system that gives you liquidity without penalties or IRS restrictions?

If any of these concerns resonate with you, it’s time to explore a tax-free wealth strategy that allows you to grow, access, and transfer your money while legally reducing your tax exposure, all without the limitations of traditional retirement accounts.

This is where the Infinite Banking Concept (IBC) comes in. Using high cash value whole life insurance as a private banking system, you can legally keep more of your money tax-free, without Wall Street volatility, and with complete financial control.

Let’s break down how Infinite Banking provides tax advantages that high-income earners and business owners can use to optimize wealth accumulation, access capital tax-free, and create a generational legacy.

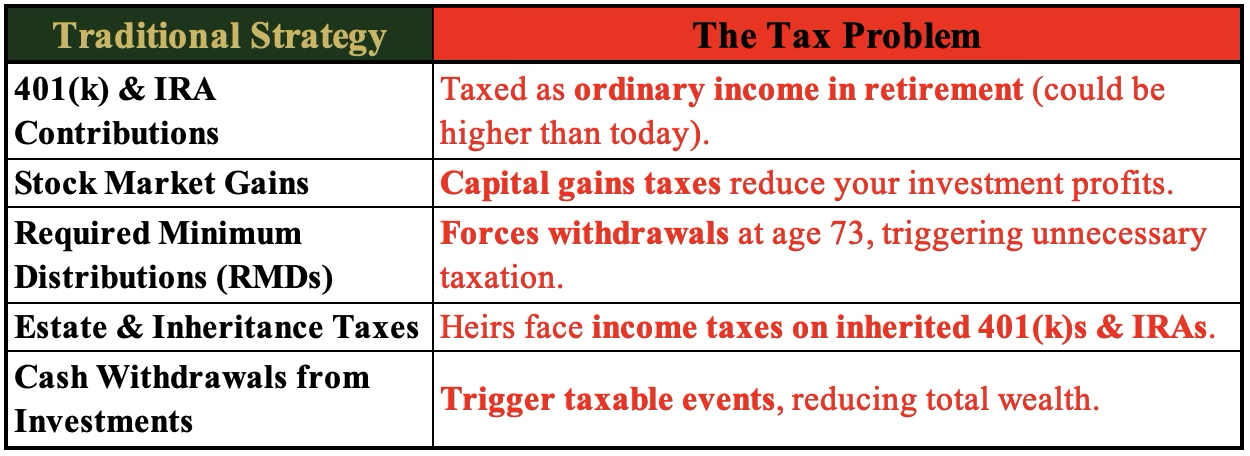

The Hidden Tax Traps in Traditional Wealth-Building Strategies

Most people are told to save for retirement using government-controlled accounts like 401(k)s, IRAs, and brokerage accounts. But these strategies come with major tax pitfalls:

Key Takeaway: If you’re successful, the government rewards you with higher taxes—unless you use a tax-free lending system like Infinite Banking.

Check Out: Infinite Banking vs. 401(k) & IRA

How Infinite Banking Provides Tax-Free Wealth Growth & Liquidity

Infinite Banking leverages high cash value whole life insurance to create a tax-advantaged financial system where your money can grow, be accessed, and transferred without unnecessary tax burdens.

✓ Your money grows tax-deferred inside the policy.

✓ You can access capital tax-free via policy loans at any time.

✓ The policy’s death benefit passes to heirs 100% tax-free.

✓ Your cash value is protected from IRS penalties and government restrictions.

Think of it as your own tax-free banking system, where YOU make the rules.

The 3 Tax Advantages of Infinite Banking That High-Income Earners Need

1. Tax-Free Wealth Accumulation

- Cash value inside your policy grows tax-deferred—you never pay taxes on gains OR dividends.

- Unlike a 401(k) or IRA, there are no contribution limits, allowing high-income earners to shelter more wealth.

- You don’t need to take Required Minimum Distributions (RMDs)—your money can continue compounding indefinitely.

The wealthiest families and corporations use this strategy to legally grow millions in tax-free wealth.

2. Tax-Free Access to Capital (The Tax-Free Lending System)

- Instead of withdrawing money and triggering taxes, you can borrow against your policy’s cash value tax-free.

- Unlike a HELOC or bank loan, you control the repayment terms, with no credit checks or loan approvals.

- Your cash value continues compounding, even when you borrow against it.

This allows high-income earners to fund business ventures, invest in real estate, or cover major expenses, all while keeping their money growing.

3. Tax-Free Wealth Transfer to Heirs

- The death benefit passes to your heirs 100% tax-free—ensuring a generational wealth legacy.

- Unlike IRAs and 401(k)s, which are subject to income tax upon inheritance, life insurance is exempt from estate taxes in most cases.

- You can use the cash value to gift money tax-free under IRS gift tax exclusions.

Key Benefit: Your family receives a financial windfall, not a tax bill.

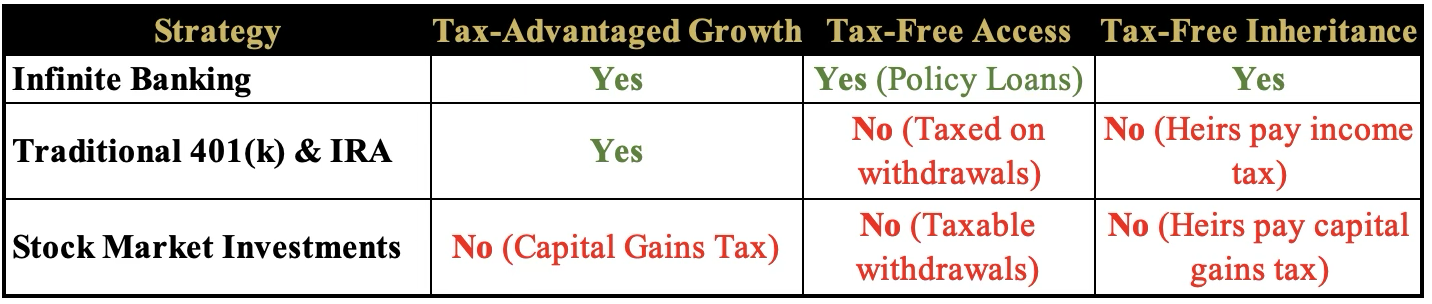

Comparison: Infinite Banking vs. Traditional Tax Strategies

Key Takeaway: Infinite Banking provides tax-free benefits at every stage: growth, access, and inheritance.

FAQs: How Infinite Banking Saves You Money on Taxes

Q. Is Infinite Banking really tax-free?

A. Yes! Cash value growth is tax-deferred, policy loans are tax-free, and the death benefit is 100% tax-free for heirs.

Q. How much can I contribute to my policy tax-free?

A. Unlike 401(k)s and IRAs, there are no contribution limits, allowing high-income earners to protect more wealth from taxation.

Q. Does borrowing from my policy create a taxable event?

A. No! Policy loans are not considered taxable income, and your cash value continues compounding.

Q. Can Infinite Banking reduce estate taxes?

A. Yes! The death benefit is tax-free and can be structured to avoid estate tax implications, ensuring more wealth passes to your heirs.

Take Control of Your Taxes & Keep More of Your Wealth with Infinite Banking

If you’re a high-income professional, business owner, or investor, you already know the tax system isn’t designed in your favor. But you don’t have to play by the government’s rules; you can create your own tax-free banking system.

Check Out: How Smart Business Owners Use Infinite Banking, How Real Estate Investors Use Infinite Banking

Your Next Steps to Financial Control

“Now What? How Do I Keep This Momentum Going?”

I get it, after reading this, you probably have questions like, “Where do I start?” “How do I make sure I set this up correctly?” and “What if I need more guidance along the way?“

That’s exactly why I’ve created resources to help you stay on track, get your questions answered, and implement this system with confidence.

WEALTHWISE BANKING PODCAST

Think of this as your weekly deep dive into everything we covered here AND MORE, but in real-world conversations. What You’ll Find Inside:

✓ Real-life IBC success stories from entrepreneurs and investors.

✓ Deep dives into Infinite Banking strategies that you won’t find on Google.

✓ Exclusive interviews with financial experts on building generational wealth.

Listen & Subscribe: WealthWise Banking Podcast

Why This Matters: The more you hear about Infinite Banking in action, the more it becomes your new financial reality.

BLOG ARTICLES & EDUCATIONAL VIDEOS

Not ready to jump on a call yet? That’s okay. Start by learning more through our blog and video library on our website. Inside, you’ll find:

✓ Step-by-step guides to setting up and optimizing your Infinite Banking System.

✓ Case studies of people just like you who are using IBC to take financial control.

✓ Answers to all the common objections and misconceptions about this strategy.

Read & Watch Here: Common Cents Solution

Why This Matters: The more you see this system in action, the more clarity you’ll have in applying it to your own life.

SUGGESTED READING LIST

Want to go even deeper? Here are four books that every Builder should have on their shelf:

✓ Becoming Your Own Banker–Nelson Nash (The original IBC blueprint—read this first!)

✓ The Creature from Jekyll Island–G. Edward Griffin (Understand how banks really work.)

✓ What Would the Rockefellers Do?–Garrett Gunderson ( How Builders create lasting wealth.)

✓ Money: Master the Game–Tony Robbins (Money strategies of the ultra-wealthy.)

Why This Matters: Infinite Banking isn’t just a strategy, it’s a paradigm shift. The more you study, the stronger your financial foundation will be. You can access these books on our website here: Books

GET A PERSONALIZED STRATEGY CALL

This is where the rubber meets the road. If you’re serious about transforming your financial future, let’s build your personalized Infinite Banking System.

Book a Free Strategy Call Here: Contact

What We’ll Cover:

✓ Your Financial Goals – Where are you now, and where do you want to be?

✓ IBC System Design – How to structure your policy for max growth & flexibility.

✓ Your Next Steps – Get clear on exactly what to do after this call.

Why This Matters: Builders take action. The fastest way to implement this system is to get expert guidance and build it the right way with Strategists who practice what we teach.