How Smart Entrepreneurs Use Infinite Banking to Fund & Scale Their Businesses

The Capital Struggle That Keeps Business Owners Stuck

If you’re a business owner, you know the struggle of accessing capital. Banks tighten lending requirements, interest rates fluctuate, and credit lines can be pulled at the worst possible time. You need capital to grow, but relying on traditional financial institutions can be risky, restrictive, and expensive.

Now, imagine if you could become your own source of financing, one where you control the terms, the interest, and the repayment schedule while growing your wealth tax-free. This isn’t some far-fetched strategy reserved for the ultra-rich. It’s a method business owners have quietly used for over a century: The Infinite Banking Concept (IBC).

Some of the most successful entrepreneurs have leveraged IBC principles to build and sustain their businesses in times of growth and crisis. Walt Disney, Ray Kroc, J.C. Penney, Doris Christopher (Pampered Chef), Coach Jim Harbaugh, and even Harley Davidson have used Whole Life Insurance as a financial strategy. Their success stories serve as powerful examples of how IBC provides long-term security and financial flexibility for business owners.

In this article, we’ll break down how entrepreneurs can use Infinite Banking to build wealth, reinvest in their business, and secure financial independence without relying on banks or Wall Street.

What is the Infinite Banking Concept (IBC)?

IBC is a cash flow strategy that allows business owners to recapture interest, build liquid capital, and create tax-advantaged wealthusing high-cash-value Whole Life Insurance policies.

Instead of borrowing from banks, you build your own private banking system using a properly structured Whole Life Insurance policyfrom a mutual insurance company. This policy allows you to access tax-free capital through policy loans, all while your money continues to grow at a guaranteed rate inside the policy.

Unlike traditional financing, IBC puts you in control, allowing you to fund growth, seize investment opportunities, and navigate economic downturns without outside interference.

Check Out: Infinite Banking Concept

Why Traditional Banking Fails Business Owners

Entrepreneurs face unique financial challenges that traditional banking doesn’t solve:

- Access to Capital is Unpredictable – Banks change lending requirements based on market conditions, not your business potential.

- Debt is a Liability, Not an Asset – When you take a business loan, you owe interest to the bank. With IBC, you recapture that interest and keep it in your system.

- High Interest & Strict Repayment Terms – Bank loans come with fixed schedules that don’t consider your cash flow cycles.

- Loss of Control – Lenders dictate terms, requiring credit checks, collateral, and repayment schedules that don’t always align with business needs.

IBC provides a self-financing system where YOU dictate the terms—giving you capital on demand, tax advantages, and uninterrupted compounding growth.

Check Out: Your Money is Making Banks Rich

Influential Business Owners Who Used IBC for Growth

WALT DISNEY: FINANCING THE MAGIC KINGDOM

In the early 1950s, Walt Disney struggled to secure traditional financing for his ambitious Disneyland project. Banks deemed it too risky, leaving Disney with few options. Instead of giving up, he turned to his Whole Life Insurance policy, borrowing against its cash value to fund Disneyland’s early development.

Result: Disneyland opened in 1955 and is now one of the most profitable entertainment enterprises in history. IBC allowed Disney to finance his dream without Wall Street interference.

RAY KROC: SCALING MCDONALD’S USING IBC

McDonald’s wasn’t always the global powerhouse it is today. Ray Kroc faced cash flow shortages while expanding the franchise.Rather than depending on outside investors, he borrowed against his Whole Life Insurance policy to cover salaries and marketing expenses.

Result: This strategic use of IBC allowed McDonald’s to scale rapidly, turning it into a billion-dollar enterprise. Kroc controlled his capital and reinvested profits into growth, without banks dictating his terms.

J.C. PENNEY: SURVIVING THE GREAT DEPRESSION

During the Great Depression, J.C. Penney faced financial ruin. Banks pulled funding, leaving the company unable to make payroll. Instead of declaring bankruptcy, Penney borrowed against his Whole Life Insurance cash value to cover payroll and keep the company afloat.

Result: J.C. Penney not only survived but grew into one of the largest department store chains in the U.S. IBC provided liquidity when banks wouldn’t.

DORIS CHRISTOPHER: LAUNCHING PAMPERED CHEF

Doris Christopher, founder of Pampered Chef, needed startup capital but didn’t want to take out high-interest loans. She borrowed $3,000 against her life insurance policy to launch her business.

Result: Pampered Chef grew into a multi-million-dollar business and was later acquired by Berkshire Hathaway. IBC was the financial foundation for her entrepreneurial success.

COACH JIM HARBAUGH: USING IBC AS COMPENSATION

University of Michigan football coach Jim Harbaugh negotiated a contract where the university funded his Whole Life Insurance policy. This unique compensation structure allows him to accumulate wealth tax-free while ensuring his financial future.

Result: Harbaugh benefits from uninterrupted growth, tax advantages, and control over his capital, a strategy more entrepreneurs should be using.

Check Out:How Visionary Entrepreneurs Are Using Infinite Banking

How Business Owners Can Use IBC for Growth

1. Funding Business Expansion & Operations

Instead of taking a traditional bank loan, business owners can borrow against their policy’s cash value to:

✓ Purchase new equipment.

✓ Expand marketing & advertising efforts.

✓ Hire employees or contractors.

✓ Cover payroll during slow seasons.

✓ Open new locations or scale operations.

With IBC, you avoid loan applications, credit checks, and restrictive repayment terms, allowing your business to grow without external financial control.

Check Out: How Smart Business Owners Use Infinite Banking

2. Creating a Cash Reserve for Emergencies

Businesses need liquidity to survive economic downturns and unexpected expenses. A properly structured IBC policy acts as an emergency fund that you can access tax-free without loan approvals or a time-consuming approval process.

Unlike traditional savings, your money is still growing, even when you borrow against it.

3. Recapturing Interest & Becoming Your Own Lender

Every time you take a business loan or finance a purchase, you pay interest to a lender. With Infinite Banking, you pay that interest back to yourself, allowing you to recapture lost capital and reinvest it into your business.

Example: Instead of paying 8% interest on a business loan, an IBC policy loan allows you to borrow at a lower rate while keeping your cash value growing uninterrupted.

Check Out: How Real Estate Investors Use Infinite Banking

4. Reducing Tax Liabilities & Creating Generational Wealth

IBC policies provide tax-free growth, tax-free access to capital, and tax-free wealth transfer.

✓ Tax-Free Policy Loans – Unlike bank loans, IBC loans are not considered taxable income.

✓ Tax-Deferred Growth – Your cash value grows inside the policy without IRS interference.

✓ Tax-Free Wealth Transfer – Your policy’s death benefit is passed to heirs or business partners tax-free, creating a built-in succession plan.

Every dollar you use within IBC works for you in multiple ways—compounding wealth while funding your business.

Check Out: The Generational Wealth Blueprint

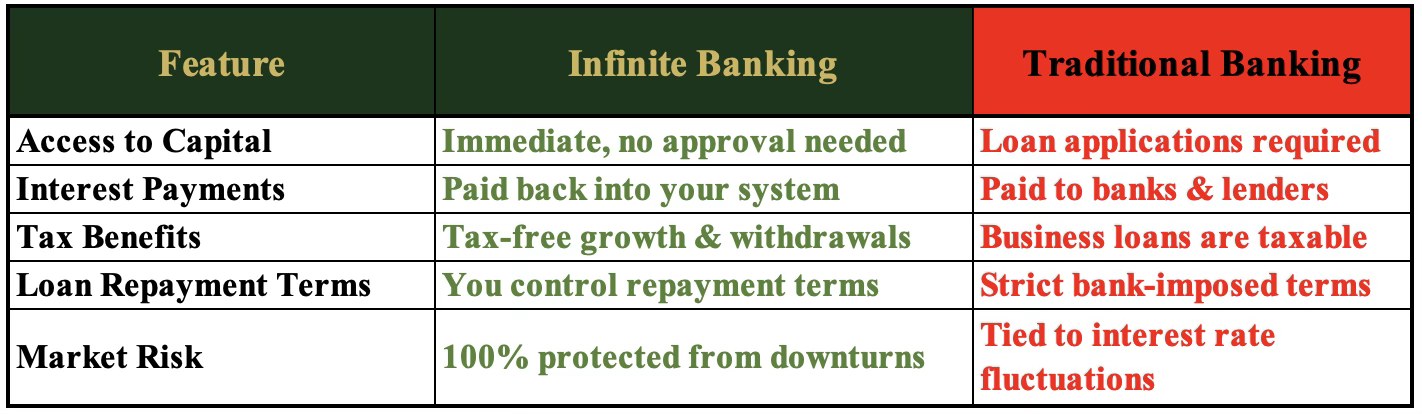

Comparison: IBC vs. Traditional Banking for Entrepreneurs

Key Takeaway: IBC provides liquid, tax-advantaged capital that puts YOU in control—while your money keeps growing.

FAQs: Addressing Common Business Owner Concerns

Q: Can I still qualify for traditional business loans if I use IBC?

A: Yes! In fact, having an IBC policy increases your financial stability, making you a better candidate for loans. Many banks recognize Whole Life policies as assets, as banks store billions of dollars in Bank Owned Life Insurance (BOLI) as their core Tier 1 Capital.

Q: What happens if my business has a slow month and I can’t make payments?

A: Unlike bank loans, IBC loans have flexible repayment options. You can adjust payments without penalties.

Q: How does IBC compare to using a business line of credit (LOC)?

A: With a LOC, the bank controls your access to capital and can freeze your funds at any time. With IBC, your money is always available.

Why Smart Entrepreneurs Choose IBC Over Banks

Infinite Banking gives you the flexibility, security, and financial leverage that traditional banking simply does not. The wealthiest individuals and most successful businesses have used this strategy for decades, and so can you!

Every day you delay implementing IBC, you’re leaving money in the bank’s hands instead of yours.

Your Next Steps to Financial Control

“Now What? How Do I Keep This Momentum Going?”

I get it, after reading this, you probably have questions like, “Where do I start?” “How do I make sure I set this up correctly?” and “What if I need more guidance along the way?“

That’s exactly why I’ve created resources to help you stay on track, get your questions answered, and implement this system with confidence.

WEALTHWISE BANKING PODCAST

Think of this as your weekly deep dive into everything we covered here AND MORE, but in real-world conversations. What You’ll Find Inside:

✓ Real-life IBC success stories from entrepreneurs and investors.

✓ Deep dives into Infinite Banking strategies that you won’t find on Google.

✓ Exclusive interviews with financial experts on building generational wealth.

Listen & Subscribe: WealthWise Banking Podcast

Why This Matters: The more you hear about Infinite Banking in action, the more it becomes your new financial reality.

BLOG ARTICLES & EDUCATIONAL VIDEOS

Not ready to jump on a call yet? That’s okay. Start by learning more through our blog and video library on our website. Inside, you’ll find:

✓ Step-by-step guides to setting up and optimizing your Infinite Banking System.

✓ Case studies of people just like you who are using IBC to take financial control.

✓ Answers to all the common objections and misconceptions about this strategy.

Read & Watch Here: Common Cents Solution

Why This Matters: The more you see this system in action, the more clarity you’ll have in applying it to your own life.

SUGGESTED READING LIST

Want to go even deeper? Here are four books that every Builder should have on their shelf:

✓ Becoming Your Own Banker–Nelson Nash (The original IBC blueprint—read this first!)

✓ The Creature from Jekyll Island–G. Edward Griffin (Understand how banks really work.)

✓ What Would the Rockefellers Do?–Garrett Gunderson ( How Builders create lasting wealth.)

✓ Money: Master the Game–Tony Robbins (Money strategies of the ultra-wealthy.)

Why This Matters: Infinite Banking isn’t just a strategy, it’s a paradigm shift. The more you study, the stronger your financial foundation will be. You can access these books on our website here: Books

GET A PERSONALIZED STRATEGY CALL

This is where the rubber meets the road. If you’re serious about transforming your financial future, let’s build your personalized Infinite Banking System.

Book a Free Strategy Call Here: Contact

What We’ll Cover:

✓ Your Financial Goals – Where are you now, and where do you want to be?

✓ IBC System Design – How to structure your policy for max growth & flexibility.

✓ Your Next Steps – Get clear on exactly what to do after this call.

Why This Matters: Builders take action. The fastest way to implement this system is to get expert guidance and build it the right way with Strategists who practice what we teach.